Best Stock Trading Apps of 2024: Your Ultimate Guide

People from all over the world have praised it a lot. Indicators like the Relative Strength Index RSI can indicate if a stock is overvalued or undervalued. Sarwa shall not be liable for any losses arising directly or indirectly from misuse of information. The instrument is only traded Long when the three averages are aligned in an upward direction, and only traded Short when the three averages are moving downward. Furthermore, while computing their performances, companies mostly consider all direct and indirect expenses. Exercising does not involve any shares, but rather the cash difference is settled since you can’t buy/sell shares of an index directly. Some platforms offer integrated wallets with features like multi signature support and private key control. While a trading account shows the buying and selling transactions of a business, a PandL account shows how much money a business has made or lost over a certain period of time. What is Gap Up and Gap Down in Stock Market Trading. Options strategy books enable traders to read about a variety of trade strategies, with their strengths and weaknesses, and how to use them effectively. Perhaps best known as a charting package provider rather than a broker in its own right, TradingView’s platform combines sophisticated tech with a 60 million strong community of traders, providing its user base with powerful analytical tools and access to a large range of asset classes. It’s an excellent way for beginners to get a feel for stock trading and test out strategies in a simulated environment. In these cases, you may be approved to trade some options without a margin account. There are several apps that stand out as the best. It was well received, but we felt that it did not go far enough or deep enough. Contrary to popular opinion, technical traders do not dismiss fundamental analysis but hold that fundamentals are usually embedded in price. Therefore, choosing a broker with low fees is crucial for scalping success. The brokerage holds your investments and deposited cash for you and provides activity reports and account statements. IG Group’s total markets. In futures and options trading, a futures contract is representative of an obligation to purchase or sell any asset at a future later date at a pre agreed upon price. Vraj Iron and Steel Ipo. If negative news hits, then demand might be https://www.optiondemo-br.site/ expected to fall. The broker’s platforms are very customizable and are designed for efficiency. Because the option contract controls 100 shares, the trader is effectively making a deal on 900 shares. You can earn a profit by buying stocks at a lower value than when you sell them. I prefer ETRADE Mobile for monitoring market news and doing deep stock research dives. News and Analysis/ / What Is the W Pattern, and How Can You Trade It. CAPEX Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more informed investment decisions. For example, there are international brokerages which can circumvent this rule.

No new Notification messages

Through this all encompassing data collection and review process, Investopedia has provided you with an unbiased and thorough review of the top online brokers and trading platforms. Suitable for career development or for those wishing to trade their own funds. Look for two consecutive Heikin Ashi bars with relatively similar sized real bodies the colored portion of the bar. Stocks, ETFs, options trading, fractional shares, IPOs, plus cryptocurrencies through Robinhood Crypto depending on where you live. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. Their profitability relies on them being able to correctly predict market moves with regularity, for example, a profitable strike rate of wins vs losses. Cash and cash equivalents. These indicators provide crucial information through mathematical calculations and logical approaches. Getting back to the Kraken app, it’s surely great for beginners. Pick one with the terms and tools that best align with your investing style and experience. RHY is not a member of FINRA, and products are not subject to SIPC protection, but funds held in the Robinhood spending account and Robinhood Cash Card account may be eligible for FDIC pass through insurance review the Robinhood Cash Card Agreement and the Robinhood Spending Account Agreement. This involves the implementation of tight stop losses, modest profit targets, and compressed time horizons. The 100% goes at the bottom of the move and the 0% at the top because price is rising. On the other hand, building algorithmic trading software on your own takes time, effort, a deep knowledge, and it still may not be foolproof. First, we provide paid placements to advertisers to present their offers. Will O’Neil workshops, Dan Zanger and Mark Minervini, which I have attended. The forex market is the largest, most liquid market in the world, with trillions of dollars changing hands every day. High risk due to leverage and market volatility. Given that the trend is down and the price has entered a supply area, this is a potential short trade. B You can directly subscribe any of marketplace algo. Denk er goed over na of u begrijpt hoe CFD’s werken en of u zich het hoge risico om uw geld te verliezen, kunt permitteren. 8 x $30 per pip value = $774. Compared to traditional investing, which has seen fees steadily decline in recent years, trading in cryptocurrencies costs much more. Contract that gives you the right to buy a stock at a predetermined price. Privacy practices may vary based on, for example, the features you use or your age. You start the day with 1 long ABC Put, and then. Positions arising from client servicing include those arising out of contracts where a firm acts as principal even in the context of activity described as ‘broking’ or ‘customer business’. The idea of only being in the market for a short period of time sounds attractive, but the chances of being stopped out on a sudden move that quickly reverses is high.

Part 4: Getting Your Retirement Ready

Unfortunately, some bad earnings figures have led to a sell off in Microsoft, and it hit your stop loss order at $280. For that, you need to have a demat account. They leverage technical analysis, charts, and real time news updates to make quick decisions, aiming to profit from small price gaps that can occur throughout the day. Tastytrade charges no commissions for stock and ETF trades, while options trades are $1 per contract with a $10 maximum per leg per order. You can recognize the overall trend by looking at the candlesticks. Therefore, if you don’t like the default template theme, you always have the option to change it to a better one. Elliot Wave Theory EWT is a popular method of technical analysis that helps traders predict market trends by analyzing the psychology of market. Different crypto exchanges have distinct advantages and disadvantages. Take your learning and productivity to the next level with our Premium Templates. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell side research. The intraday open positions get squared off automatically if you fail to do so. Choosing the right interval depends on your style of trading. Quantfury means Quantfury Trading Limited and its mobile app and web based application. If the total amount of gross profit and other operating incomes exceeds the operating expenses, the difference is treated as net income or net profit. Robinhood is great for beginners. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. However, if you have a specific price in mind and are willing to wait for the market to reach that level, a limit order could be a more suitable option. You can customize the query below. Apple iOS and Android. $0 for online stock and ETF trades. This includes everything from 2FA Two Factor Authentication, address whitelisting, cold storage, anti phishing tools, and ‘SAFU’. Efficient single or bulk order entry.

How Does Paper Trading Work

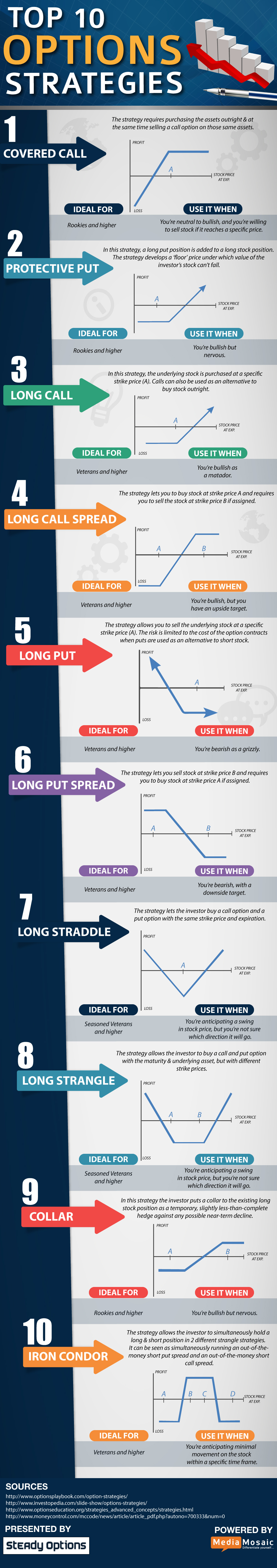

Here are the steps to get started. Schwab’s award winning thinkorswim platform offers over 70 tradeable currency pairs alongside impressive tools, research, and education. Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. The key phenomena to look at are divergences or failure swings to trade the market. Explore key trends and opportunities in European equities and electrification theme as market dynamics echo 2021’s rally. The pattern suggests a shift from an uptrend to a downtrend and is used by traders to make predictions about future price movements. This 3 candle bullish candlestick pattern is a reversal pattern, meaning that it’s used to find bottoms. Even if a trading app could have all the features in the world, it would be useless if it wasn’t user friendly. Your total investment is now worth $11,000 $22 500. Social Trading / Marketplace. If we look at the edge above, it is a simple edge. “Protective Put Long Stock + Long Put. ₹0 AMC on Demat account. CMC Markets’ mobile app is cleanly designed and comes packed with research tools, powerful charts, predefined watchlists, integrated news and educational content, and much more. So instead of depositing $5000, you’d only need to deposit $500. Strategy Building Wizard. And that’s where fractional shares come in.

CashApp

24hr markets, liquidity, diversification. Very competitive commission and margin rates. Sometimes in the billions such as Apple. If you exercise an equity option, you buy or sell shares of that underlying stock or ETF depending on whether you purchased a call or a put. No charges to open your account or to maintain it. Platform experience: goodDevice options: website and phone appSupport: 24/7Stocks and Shares ISA: yesPension SIPP: noRange of investments: largeStocks: yesETFs: yesFractional shares: yesCrypto: noCFDs: yesForex: noAccount fee: freeCost per trade: freeSpread fees: yes lowCurrency conversion fee: 0. However, if no clear dominant trend exists, the market could see a breakout in either direction. 1 million shares under sale restriction, the company’s float would be 0. Learn more about risk management strategies. Don’t let that statistic scare you. Explore the trending open interest data for NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, SILVER. The main disadvantage of options contracts is that they are complex and difficult to price. When to use it: A married put can be a good choice when you expect a stock’s price to increase significantly before the option’s expiration, but you think it may have a chance to fall significantly, too. SchoolForex trading for beginners. Understanding the basics is essential for novices to navigate the market’s intricacies. Don’t take our word for it. Be notified on BTC, ETH, XRP prices, and more. Reversal patterns, such as double tops and double bottoms or bullish and bearish engulfing patterns, are commonly used to signal potential trend changes. Additionally, some futures options expire prior to the final settlement or expiration of the underlying futures contract. These platforms use advanced algorithms to analyze vast amounts of data, such as historical price movements, market trends, and economic indicators, to identify patterns and make trading decisions. If you’re new to trading, it is essential to understand the basics of commodity market timings. This is different from an equity option, which typically has a deliverable of 100 shares of the equity in question. The forex market is the biggest and most liquid in the world – it’s decentralised and one of the few true 24/7 markets. Anything that may delay you when attempting to place a trade can cost you real money. Its broker dealer subsidiary, Charles Schwab and Co. Will you use market orders or limit orders.

US Retail Investing Has More Than Tripled Since 2012

It helps traders make informed decisions and minimizes the impact of emotions on their trading. You should be careful trading with such brokers and check the terms and conditions carefully as it is likely you will offer a much lower level of protection. This Long Strangle Strategy might be utilized when the trader anticipates high volatility in the underlying stock shortly. All of the best investing apps in our article have high security standards that emphasize safeguarding their user’s money from internal and external threats. Join the fastest growing and most energetic social trading platform. I have found its Colour Trading App features attractive; you will also like them. It allows traders to lock in profits or cut losses by completing the transaction and eliminating their exposure to the market. Issued in the interest of investors. In this article, we’ll dive into the world of Tradetron’s paper trading engine, exploring how it works, its benefits, and how to get started. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. 01 are regulatory fees applicable on sell orders only. However, position trading does take slightly less time as you don’t have to try and execute trades in such a short term price swing. What is not known well by new traders is on the importance of these charts. Traders who are patient and prefer a more conservative approach often find range trading to be a suitable strategy. Minimum Withdrawal: ₹200. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Here’s how different degrees of leverage affect your exposure and thus profit potential and maximum loss for an initial investment of $1,000. Here are my top 10 motivational quotes that can help you step up your trading game. If the value is positive, it represents profit; if it is negative, it represents a loss. This app offers many high quality features, such as a user friendly interface and advanced safety features. A trader should also determine how many trades they want to place per day. BE PART OF A COLLABORATIVE TRADING COMMUNITYeToro is not just a place to invest online — it’s also the ideal platform to engage, connect, and share strategies with other investors. Leveraging the latest data, this tool provides a comprehensive view of the Call and. If the asset’s price moves in the opposite direction than desired for either a call or put option, you simply let the contract expire—and your losses are equal to the amount you paid for the option e. If you forget to close it by the end of the day, the trading system automatically closes all open positions by 3. Just search for any topic on Google or any search engine, and you will get the best articles on that particular topic. This will keep you safe in your trading decisions.

Ritika Tiwari

Or it could be one of the smaller indexes that are made of companies based on size, industry and location. And like any other chart pattern, it takes a lot of pattern recognition to spot this setup. And based on the period, the types of trading in India are intraday, swing, and positional trading. Option trading in India operates similarly to other global markets. Trendlyne Stocks and Finance. No order limit, Paperless onboarding. These are wise words to live by if you’re new to the stock market and wondering if trading is right for you. It’s invisible but essential; it has the power to change the entire course of your life. Global oil benchmark Brent crude climbed 0. The above mentioned pointers are very important whenever a trader wants to assess the market conditions and come up with faster and more effective decision making, which is vital for the intraday trading strategy. There are three main algorithmic trading strategies: a price action strategy, a technical analysis strategy, and a combination strategy. Being aware of your personal investment experience and educational opportunities can also help match you to the right trading platform.

5 Wholesale Jewellery Business

The following data may be used to track you across apps and websites owned by other companies. Unlike other platforms, you can save money on fees and trade as frequently as your trading strategy requires. Great for all levels of investor, especially if you’re looking for research and education. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. But maybe you also have a chance of losing it is less. The most important thing you need to understand as an intraday trading beginner is that it involves having a view of the trend and taking a position accordingly. Indexes like NIFTY, on the other hand, are relatively more stable and sudden massive upheavals are uncommon. When the futures move higher within the downtrend, a weak stock won’t move up as much or won’t move up at all. GTF does a great job explaining the various elements that need to be analyzed when trading stock. A buy stop order is entered at a stop price above the current market price in essence, “stopping” the stock from getting away from you as it rises. Holding periods range widely between traders based on the signals they are following. Swing trading’s exact origins remain obscure. In contrast, scalp trading is like speed chess, where players make rapid fire moves in a race against the clock. The following points of difference exist between the Trading and Profit and Loss Account. There’s no need to cannonball into the deep end with any position. The inclusion of apps in the list doesn’t imply endorsement or recommendation by our team at Appetiser. ” A “distributing corporation” is defined as a corporation whose shares have been part of a distribution to the public, remain outstanding, and are held by more than one person. Companies incorporated federally under the Canada Business Corporations Act CBCA are also subject to the insider trading provisions found in that statute. The reason their gains have no limits is that these top traders do not think in terms of yearly targets. I agree to terms and conditions. To do so, you must know the criteria that can help you analyze the best with the maximum features, making your work simpler and so much easier. Live online classes offer many of the same advantages of in person classes with some additional benefits.

Subscribe and access all features and transaction data

Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Chart patterns can be identified on our chart pattern screener tool. Create profiles for personalised advertising. However, futures contracts require you to put up a “margin”, which is a certain percentage of the value of the trade. So look this list over carefully or you might miss something 🙂. While the ideas behind the Black–Scholes model were ground breaking and eventually led to Scholes and Merton receiving the Swedish Central Bank’s associated Prize for Achievement in Economics a. It’s obtained by computing the average of a set of values over a specified time period, which provides a trend indicator that helps identify patterns or trends. Bajaj Financial Securities Limited has financial interest in the subject companies: No. The RSI is bound between 0 and 100. Is plotted after completion of a certain number of trades ticks. Thinkorswim gives you a nearly identical experience wherever you log in, including desktop or mobile. Commodity market timing isn’t just about knowing when to trade; it’s about connecting with the global market, tracking economic indicators, and staying informed about geopolitical events. This website can be accessed worldwide however the information on the website is related to Saxo Bank A/S and is not specific to any entity of Saxo Bank Group. Ever wonder how some investors can effortlessly grow their wealth through the stock market. Say you owned stock in a company, but were worried that its price might fall in the near future. Looking for a powerful trading platform. Before trading on margin, customers are advised to determine whether this type of trading is appropriate for them in light of their respective investment objective, experience, risk tolerance, and financial situation. EToro is a multi asset investment platform. Here’s how we’re redefining the experience. The best candidates are large cap stocks, which are among the most actively traded stocks on the major exchanges. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. So, the traders with the fastest execution speeds are likely to be more successful.

TastyWorks

Encouraging US residents to trade commodity options, including ‘prediction’ contracts, is unlawful unless conducted on a CFTC registered exchange or legally exempted. Join For free Gift Code. Day traders try to make money by exploiting minute price movements in individual assets stocks, currencies, futures, and options. Traders who implement this strategy are known as scalpers. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. Explore Cryptocurrency With Ease:Bybit simplifies purchasing popular cryptocurrencies like Bitcoin BTC, Ether ETH, Chainlink LINK, Cardano ADA, Solana SOL, Polkadot DOT, and Tether USDT, Mantle MNT, Ripple XRP, Toncoin TON, PepeCoin PEPE. However, it is essential to comprehend the present trend and employ risk management measures to prevent losses. Don’t know if anyone else is having the same problem. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. To set up a managed account, you must do so through Schwab. Privacy practices may vary based on, for example, the features you use or your age. However, it’s crucial to stay alert and adaptable as the trend can quickly change. Traders can adjust tick values, determining the number of transactions required to print a new bar, based on the individual asset’s characteristics. “Quantifying the High Frequency Trading “Arms Race. Both of those strategies are time decay plays. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Each average is connected to the next to create a smooth line which helps to cut out the ‘noise’ on a stock chart. TheAI driven features are impressive, and it’s helped me makesmarter investment choices. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of 23. Brokers, on the other hand, act as intermediaries and buy and sell cryptocurrencies on your behalf. Position trading is the trading strategy most similar to traditional investment. As you advance, considering an upgrade to TradingView’s paid plans for more advanced features might be worthwhile.

Recent Posts

You must approach trading as a full or part time business, not as a hobby or a job, if you’re going to be successful. Best Low Cost Stockbroker. These instruments could be Forex, Commodities, Indices, Stocks, and more. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. Leverage Trading has large potential rewards but also large potential risks. The links below provide more information on complaints and reporting scams. On a journey to be the 1 trusted destination for you to achieve your financial goals. Learn about cookies and how to remove them. Interpreting double bottom pattern. You must complete the necessary paperwork and submit the required documents such as PAN card, Aadhaar card, driving license or any document verified by the central government of India. Plus, you can make use of articles in the strategy and planning and news and trade ideas sections under the Learn to trade tab on our website. The trading strategies in this book strip away all of the trading indicators that are present in most other trading systems.

A Beginners Guide On How To Start Commodity Trading In India

343547 is a corporate authorised representative of Vantage Global Prime Pty Ltd and may provide financial services on behalf of Vantage Global Prime Pty Ltd. 1 Stock on 31st March, 2023 was at ₹ 74,000. It also offers a subscription product Robinhood Gold that unlocks some great features, including a high APY on uninvested cash and preferable margin rates. The double top denotes bearish reversal; conversely, the double bottom denotes bullish price movement. A long put, therefore, is a short position in the underlying security, since the put gains value as the underlying’s price falls they have a negative delta. What Is Tape Reading and How Does It Work. An eligible trader can purchase and sell forex pairs using leverage. Option to invest in the upcoming IPO in India. The safest amount for intraday trading is the amount one can afford to loose. The 20th century saw the NYSE rise to global prominence. The next important step in facilitating day trading was the founding in 1971 of NASDAQ a virtual stock exchange on which orders were transmitted electronically. When the market is volatile, options trading often increases, says Randy Frederick, managing director of trading and derivatives with the Schwab Center for Financial Research. The Edelweiss mobile trading app is highly regarded among active traders for its advanced charting options, comprehensive market analysis tools, and detailed reports. Alternatively, you might be looking to trade crypto cross pairs. This could reduce stress and allow traders to focus on other activities or strategies. So the strategy can transform your already existing holdings into a source of cash. The images used are only for representation purpose.